How to Create a Succession Plan for Your New Zealand Family Business

30 Jul 2025

Some days you’re the pigeon, some days you’re the statue. This humorous saying (popularised by David Brent from The Office) captures how running a family business can feel. One day everything goes your way, and the next day you’re dealing with unexpected challenges.

When it comes to eventually stepping away from your business, you don’t want to leave it up to chance which day it will be. That’s where succession planning comes in – and why you should start thinking about it now.

Why Plan Your Succession?

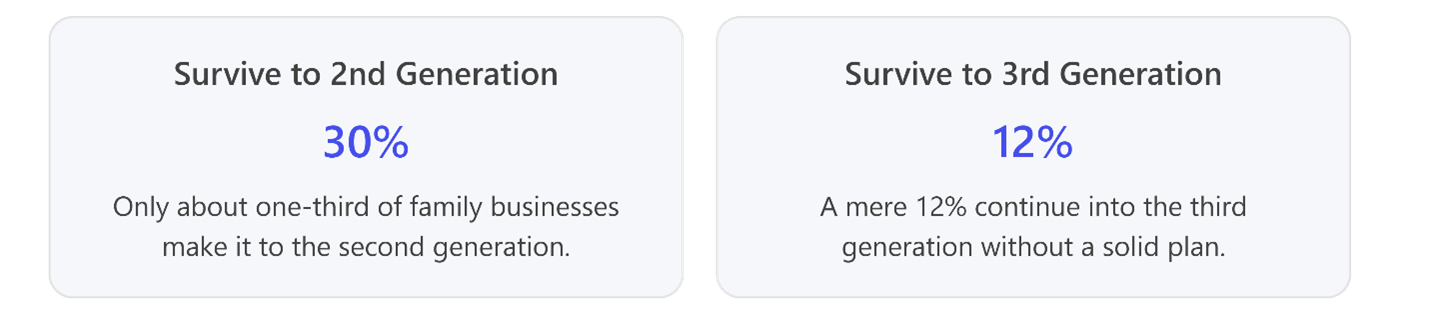

“Succession planning” means preparing to hand over the reins of your company to someone else – whether that’s your children, employees, or an outside buyer. If you’ve poured years of hard work into building your business, you want to see it continue thriving after you step back. Without a plan, the odds aren’t in your favour: studies show most family firms fail to survive leadership transitions beyond the first generation. Lack of planning can lead to chaotic scrambles, family conflicts, or even the business collapsing when an owner retires or faces an unexpected crisis. In short, a well-thought-out succession plan is key to protecting your legacy and the livelihoods of employees and family members who depend on the business.

It’s a Journey, Not a One-Time Event.

Many owners put off succession planning. It’s easy to think “I’ll deal with that in a few years,” especially if retirement feels far away or you assume a big buyer will one day swoop in with an offer. In reality, succession is a gradual process, not a single event. It can take years to groom a successor, get the business ready for sale or transition, and work out finances and roles.

Starting early lets you drive the process on your own terms, rather than being forced into a rushed exit by health issues or market changes. And even if you do hope to sell the company eventually, having your house in order with a succession plan will make your business far more attractive to buyers.

What Does a Succession Plan Include?

At its core, a good succession plan answers “What happens to this business when I’m not running it?”

It typically involves:

- Defining your goals and timeline: Do you plan to retire at a certain age? Keep some ownership or step away completely? Identifying your objectives will guide the plan.

- Choosing a successor (or successors): Will a family member take over, or an outside manager? Perhaps you’ll sell to key employees (a management buyout) or merge with another company. Weighing these options is crucial.

- Business readiness: A frank assessment of your company’s current state. Are there gaps in leadership skills? Does the business rely too heavily on you personally? Shoring up any weaknesses early will make for a smoother handover.

- Valuation and finances: Determining what the business is worth and how a transfer might be funded. This could involve setting a fair price for shares, planning for estate taxes, or arranging financing if, say, your children will purchase the company over time.

- Training and knowledge transfer: If your daughter, son, or protege is going to run the company, they might need mentoring or new expertise. Slowly passing on your knowledge and relationships gives the next leader confidence and credibility when the time comes.

- Contingency planning: Life is unpredictable. A good plan covers “what-ifs” – e.g. if the chosen successor decides to leave, or if you face an earlier-than-expected exit. This often means grooming more than one person or having a backup strategy.

- Family dynamics and communication: In a family firm, emotions and relationships run deep. It’s vital to communicate plans openly to avoid resentment or confusion. Many succession plans establish clear roles for family members (who will own shares vs. who will manage daily operations) and use written agreements to prevent misunderstandings.

Don’t Let “Shoestring Syndrome” Hold You Back.

Unfortunately, too many small and mid-sized business owners keep putting off these steps. They might assume things will “go back to normal” if the economy has been tough, or they simply hate thinking about giving up control. This “dig your toes in the sand” reluctance can be risky. Without preparation, you could end up with limited options — for example, if a would-be successor (like a son or daughter) gets frustrated at the lack of progress and leaves to pursue their own career. We’ve seen business owners who overvalue their company or avoid hard conversations, only to find no one is willing or able to take over when they’re finally ready to exit.

Time to Take Action – What’s Your Next Step?

Reading this, you might be thinking about your own company. Maybe you’re not planning to retire for another decade, or maybe you’d like to pull back next year. In either case, now is the time to start the conversation and sketch out a plan. Succession done right can take years, and starting early never hurts. Begin by engaging in some frank discussions with key stakeholders (family members, business partners) about the future.

Talk to your accountant or a business advisor about your options – for example, Andersen’s advisors specialize in helping business owners navigate this journey. Identify potential successors and start involving them in more aspects of the business. Even small steps, like delegating more responsibilities or organising your financial records, can make a big difference down the line.

Don’t leave your business’s fate to chance. You’ve worked too hard to see things fall apart when you step aside. Start your succession plan today.

Planning ahead will give you peace of mind and ensure your business – and legacy – continues to flourish for generations to come. If you need guidance on where to begin, the team at Andersen is here to help. Reach out for a friendly chat about how to protect the future of your family business – you’ll be glad you did.

Author – Mike Atkinson

Our Latest Insights

2025 NZ Tax Recap for Businesses

Discover the essential tax changes for New Zealand businesses in 2025, including investment incentives, compliance updates, and upcoming Kiwisaver and FBT proposals. Prepare for 2026 with expert insights and practical reminders.

Understanding and Mitigating Business Risk in 2026

Heading into 2026 with a mix of economic caution, rising operational pressures, and fast-moving global risks? This article outlines the major challenges shaping the year ahead and explores the practical steps business owners can take to strengthen resilience, protect performance, and position for growth.

Announcing Andersen North Shore

Andersen proudly announces expansion into Auckland’s North Shore. Discover how this strategic partnership with WBB Chartered Accountants benefits local business owners with enhanced experience, services and support.

Why Regular Financial Reporting is the Growth Engine for New Zealand SMEs

Regular financial reporting helps New Zealand businesses turn numbers into strategy. Stop flying blind — build the visibility, confidence, and control needed to make smarter decisions and drive sustainable growth.